How to Grow Your Brokerage by Diversifying Your Mortgage Lenders

One of the many benefits mortgage brokerages have over retail operations is their ability to work with a variety of lenders. Unlike retail operations, independent mortgage brokers can shop around for the best loan option for their clients, which allows them added flexibility that will help brokers work with an ever-growing diverse client base.

As homebuyers across the country continue to diversify, so do their needs. In order to remain competitive in an increasingly competitive purchase environment, mortgage brokers need to provide an array of loan options from a variety of wholesale mortgage lenders to fully support the changing demographics of the American homeowner.

The Urban Institute expects Hispanic homeownership to see the largest increase with an additional 3.8 million homeowners between 2020 and 2040, In that same span, Black homeownership is expected to grow by 1.2 million.

Increased Optionality

Today’s shifting demographics of homebuyers are one reason why building a diverse lender portfolio is crucial for any broker’s long-term success. A variety of available mortgage lenders can allow a loan originator to access multiple loan product options that can help them serve a broader client base for years to come. Oftentimes, brokers act as mortgage experts in their local communities, which comes with an inherent understanding of the needs of their neighbors. Because each borrower’s scenario is unique, the more options that are available in a broker’s toolbox, the better positioned they are to get them approved and into a home.

For Evan Einhorn, President and Loan Officer of Modern Home Lending, working with multiple lenders offers his clients optionality. For the most part, a large majority of his borrowers fit into a conventional loan, which allows him to shop around for the best value, but there is a small subset of his client base that may get turned away by a handful of lenders before they find one that works for their situation.

“I’ve had several deals where I checked with [a dozen] of our lenders and got 10 nos, but finally got a yes,” Einhorn said. “You know, even though there are guidelines, and they should be cut and dry, there are a lot of guidelines and scenarios that are up to underwriter discretion and lender discretion. That’s where we come into play as a broker.”

Using a variety of lenders also became incredibly important for Einhorn during 2020. During the height of COVID-19, he saw many lenders raise their rates following a major influx of business. Being a broker, Einhorn had the option to use other lenders when prices began to rise, allowing him to stay competitive in the market.

For Corrina Carter, CEO of CMS Mortgage Solutions, her most commonly used lenders make up about 60% of her business with the other 40% split between a handful of other lenders who offer more niche loan products. These less conventional lenders that handle Non-QM or renovation loans still earn about 5 to 7% of her business, which accounts for an extra 30 to 50 loans a year, Carter said.

“Five to seven percent out of a thousand loans is gonna be anywhere from thirty to fifty loans that we may not have gotten if we didn’t use those lenders,” Carter said.

If you are looking to add a new lender, AIME can help you get connected with its vetted partner lenders. Just email partnerships@aimegroup.com to get connected.

Add and Vetting New Lenders

Even though having a range of lending options is recommended, there has to be a justifiable reason to add a lender because the process to identify and vet a new lender can take time. “The lender could offer a unique product, or a fellow broker recommended them or they are just pricing competitively,” says Brendan McKay, Owner and Senior Loan Officer of McKay Mortgage Company and AIME’s President of Broker Advocacy. If a lender is simply pricing their loans competitively, McKay suggests utilizing the Brokers are Better Facebook group to source feedback from other brokers before trying to use that lender.

After identifying a new lender he wants to work with, he starts the relationship by sending them a low-risk loan, almost always a refinance. That way, he can work with the new lender and learn their processes without the pressure of having to close quickly. McKay will also sometimes ask the lender to introduce him to a broker they do business with as a reference. It’s important to note that he is also careful to let his client know he is using their loan to test out a new lender, which might mean a little more road bumps than normal.

“If we encounter any delays while testing out a new lender, I will usually cover any costs. The borrower should not pay to be your guinea pig,” states McKay.

If that process goes well, he will typically start sending more loans their way. McKay does urge patience when using a new lender, however, because he felt it is unrealistic to expect your first transaction to be completely smooth.

“If you’re going to write off a lender after the first loan just because you have a couple of bumps, then your expectations are unrealistic, frankly,” McKay said. “Now, there’s a difference between a couple of bumps in a full-on disaster and you need to gauge that.”

If a broker has issues with an AIME partner lender, new or old, they can escalate the issue to AIME by filling out the escalation form.

Choosing the Right Wholesale Mortgage Lender

Just because a lender is right for one broker does not mean they are right for every originator. Every brokerage is unique and it is up to each broker owner to determine exactly what they are looking for in a lender and how that lender will support their pipelines’ needs.

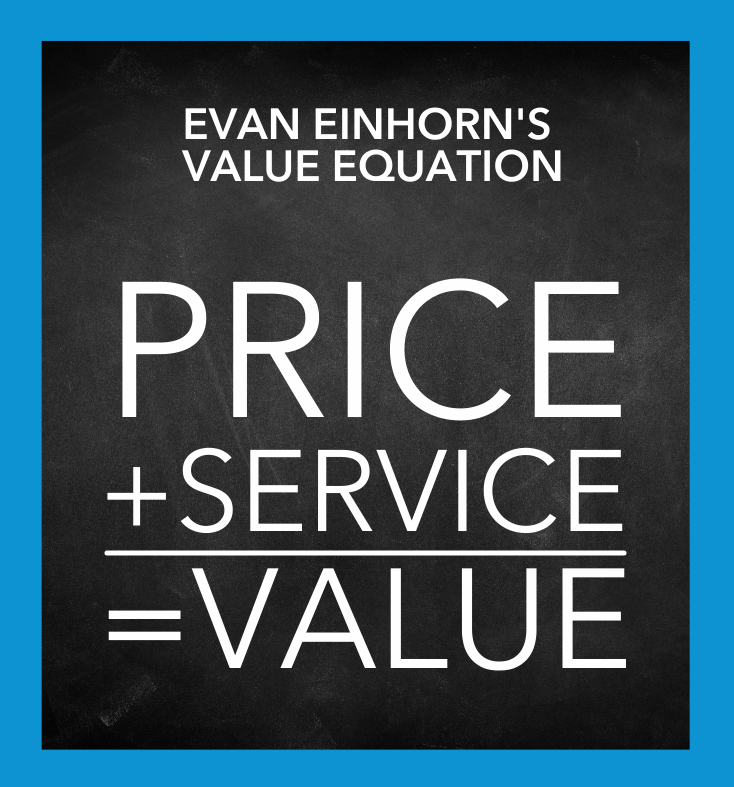

Ultimately for Einhorn, the choice to use a lender comes down to value. For him, that is not simply the cheapest option or the one with the best service – it is a balance between the two.

“If there’s a lender that is by far the best in service and it’s gonna be a frictionless process but they’re a little more expensive, then we’ll go with that lender.”

Einhorn explained it as a sort of mortgage golden rule. You should choose the option you would want to take if you were in the borrower’s situation.

When Carter begins looking for a new lender, she focuses on what she calls her “hot buttons,” or simply the most important factors for her. For Carter, those include underwriting turn time, condition review turn time, and their CD process. If a lender performs well in those areas and prices competitively, she will likely use them.

“Once we’re told what those are, we kind of decide to court them, as I would call it,” Carter said. We send them a few deals to see what that looks like and get feedback from the processors on how their communication flow was where they fell short.”

It also helps that Carter is careful to send lenders, especially new ones, a very clean package. If she can control her side of the transaction, then any issues with the loan would likely be on the lender, which helps her better vet new lenders.

Maintaining Mortgage Lender Relationships

Maintaining a strong work relationship with your lenders is key to a broker’s success. In a perfect world, a broker would send an equal amount of business to each of their lenders. In reality, those relationships ebb and flow, which is why maintaining them is so important.

For Einhorn, the key is transparency.

“I think it’s important for brokers to work with lenders and provide feedback when processes don’t go well,” Einhorn said. “So, when we’re trying out a new lender I am always extremely transparent with the lender if something goes wrong.”

That transparency extends to his everyday lender partners as well. Lenders will often call and ask why they are not receiving more loans from Einhorn’s company. In response, he sends them statistics on how much of his business that lender receives.

He will also highlight specific parts of the processes where he had issues with the lender’s service. From there, he gives the lender the chance to win back his business, but that lender will likely receive long-term finance until they earn back his trust.

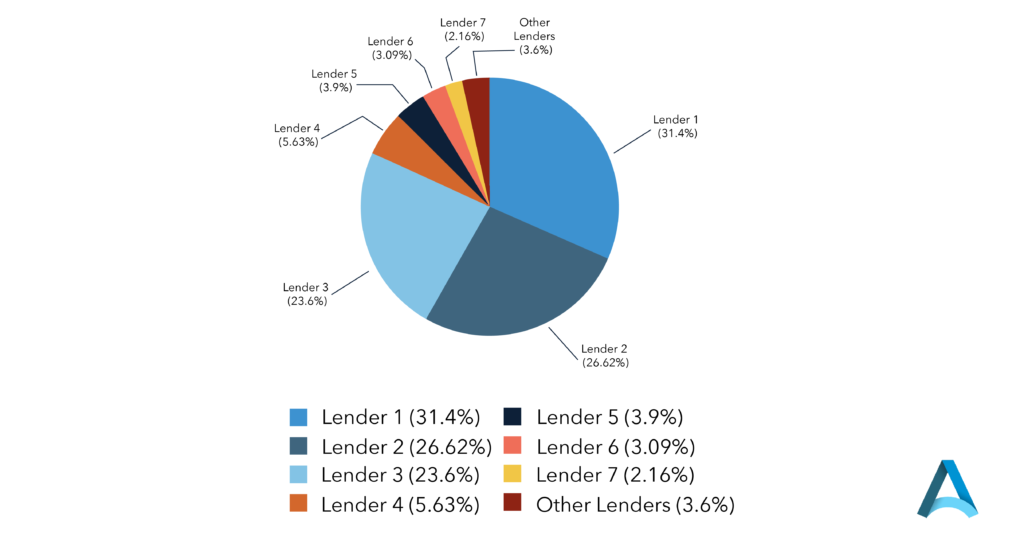

McKay is also very transparent with his lender partners. He sends the majority of his loans to three lenders with a few others lenders receiving the rest of his loans. Similar to Einhorn, he is very upfront with how much business his lenders can expect. Communicating realistic expectations to your lender partners is important in building a relationship from scratch.

Brendan McKay’s lender breakdown

Another key to maintaining your relationship with lenders is knowing your capacity. For a small shop or a one-person brokerage, McKay suggests starting with one or two lenders. If a brokerage does not have a robust operations team, it may be difficult to manage multiple lenders with different processes.

Key Takeaways

One of the most important things for brokers, and what makes them brokers, is their ability to work with a variety of lenders. Not only does that ability allow brokers to shop for the best price and process for their clients, but also allows them to handle unconventional loans. That optionality may be even more important as a more diverse and younger group of people begin looking for homes.

If you are looking for a new lender, check out AIME’s vetted and approved partner lenders. You can also keep up-to-date on those lenders through AIME’s lender updates.

- Develop a competitive edge by increasing loan optionality

- Have a reason to add a new lender and vet diligently

- Test new partners with a refinance first

- Choose new partners based on benefit to the borrower

- Provide transparent feedback to new lender partners

- Communicate realistic expectations

- Know your capacity limitations