How to Maintain Your Credit Health in Uncertain Times

COVID-19 has created an unprecedented unemployment rate in a short period of time, which is impacting, or will soon begin to impact, the credit health of many homeowners and potential home buyers. Your credit score is essential to your purchasing power in the future. Whether it is a refrigerator purchase for the home you already own, a refinance for a lower monthly payment or you aspire to buy a home in the near future, making wise choices now is essential. If your household income has recently changed, there are ways to protect yourself so you can resume life following this pandemic with little or no impact on your credit.

This blog article is sponsored by CIC Credit, an approved AIME Lender Partner. CIC Credit has served the industry since 1921. CIC has brokers covered with their cloud-based delivery system executing instant, real-time results, and an award-winning API delivery system. Not connected with CIC Credit? AIME will make the introduction. Log into the AIME Portal today to get connected.

8 Tips to Repair and Improve Credit Score

If you have good credit and want to preserve it or not-so-great credit and you don’t want to make it worse, My Credit Guy CEO, Sam Parker, provides insight into the proactive decisions you need to make in order to protect your credit during financial hardship.

- Pay Your Mortgage First

If your income was reduced due to a pay cut or furlough, look at your biggest bill (most likely your mortgage) first and think about eliminating or reducing it temporarily by contacting your loan servicer to see if a mortgage forbearance to pause your payments is the right choice for you. Your home is your biggest piggy bank and an investment that provides important equity for your future. When financial hardship hits, remember that missed mortgage payments will have a bigger impact on your credit score than missed payments on smaller bills, so make sure to do everything you can to make your mortgage payments.

- Eliminate Unnecessary Bills

Small bills can really add up and in a stressed economic climate, this is an opportune time to evaluate if you really need Hulu AND Netflix, a gym membership, make-up subscription service or other non-essential household or lifestyle charges that you can resume once your income is back on track. - Evaluate Recurring Subscriptions

Are there any other recurring subscriptions you forgot you have? Take a look at your bank and credit card statements to make sure you aren’t paying for internet storage that you don’t use, or a music subscription you forgot to cancel after the free trial. These are expenses you can eliminate during a hardship to enable you to pay other bills that will affect your credit. - Consider Utility Payment Plans

Not all of your monthly bills affect your credit, so lowering the ones that don’t should be your top priority. During this time, most utility companies are offering payment plans or deferring payments and suspending shut offs. Call your electric, water, and gas companies and find out how they can work with you to reduce your payments. Other household bills like internet, cable, and mobile phones might also be places to save. Did your promotional trial for cable end and your bill silently went up? It might be cost-effective to sign up with a new provider that is offering a reduced price for the first year of service. If you are now working from home, keeping essential services is a part of your income and shouldn’t be compromised, so make decisions that work for you. - Contact Your Student Loan Servicer

On March 20, the Department of Education announced that Federal Student Loans will automatically have interest rates reduced to 0% for 60 days and borrowers will have the option to elect to have their payments suspended for two months. If borrowers continue to make payments, 100% of the payment will go toward the principal of the loan. For non-government student loans, contact the student loan servicer directly for hardship options. Many already have these plans in place for non-COVID related hardships. - Call Your Credit Card Company

While policies vary, most credit card companies have relief measures in place. Options include deferment of payments and interest for a select number of months or the lowering of the minimum payments. You still need to make your minimum payments on credit cards to avoid damage to your credit score, so reach out to your creditors as soon as possible to avoid late payment charges.

If you think you will be using your credit card more during your financial hardship, it can also be beneficial to ask for an increased credit line. This credit increase is not necessarily for you to use for purchases, but intended to improve your credit score by enhancing your credit utilization ratio, or the amount of your available, unused credit balance. For example, if you have a $1,000 credit card limit and maintain a $900 balance, your credit score can be negatively affected over time because your ratio of credit utilization is high. If you have a $2,000 card limit and maintain a $900 balance, this credit utilization will be lower and have a much lower impact on your credit score. - Contact Your Auto Loan Lender

Each creditor that My Credit Guy contacted had their own stance on how they will help customers. Some said that they will offer up to three months of no payments and some said that it is a case-by-case basis but that they will work with customers who communicate with them. In many cases, your vehicle is your method for getting transported to work once the pandemic passes, so it is important not to get behind on these payments. Call your auto loan lender to discuss alternative payment options. Like a credit card, a missed auto loan payment will directly affect your credit score so prioritize this payment when reviewing your monthly spending. - Review Your Rent Payments

Whether you are currently renting, if you rent a secondary home or if you have other rental payments like a storage unit, these can eventually impact your credit if the landlord reports delinquent payments. The best course of action is to review your current rent payments, call your landlord and explore your options.

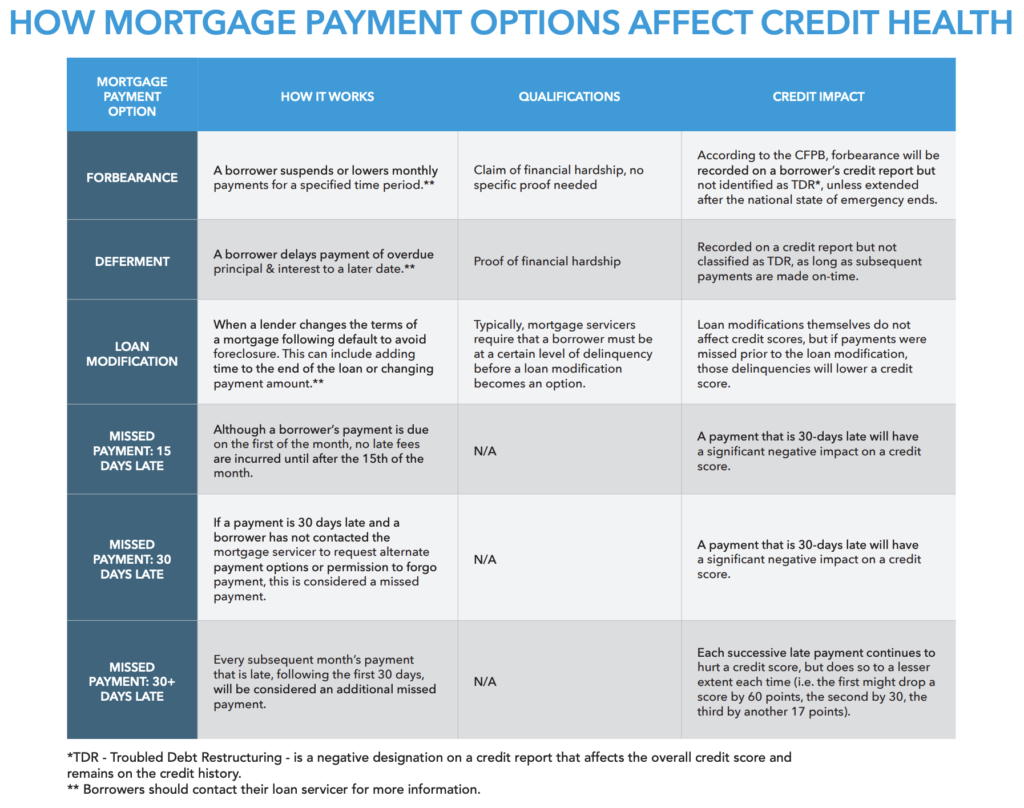

For help understanding how your mortgage loan payments affect your credit health, refer to the chart below:

Download Loan Payments Chart

Does Forbearance Affect Credit?

Most large mortgage servicers have already put relief options in place, including mortgage forbearance, deferment, repayment plans and loan modifications. If you have taken all the above measures to minimize your expenses and still cannot make your mortgage payment, then reach out to your loan servicer for options. It is important to know what each option presented to you means, so be sure to discuss them with an expert advisor such as your mortgage broker, as well as your loan servicer to make sure it is the best option for you.

Keep in mind that at the end of mortgage forbearance you will be responsible for working with your loan servicer to find a repayment option that works best for your circumstance. The Federal Housing Finance Agency has issued guidelines for your ability to refinance or qualify for a new loan in the future so taking forbearance should not have a long-term effect on your ability to buy in the future.

Also read: How Forbearance Impacts Mortgage Brokers and Homeowners

Additional Quick Tips for Improving Credit Health

While thinking about your credit score may seem like a “tomorrow problem,” it can quickly have a huge effect on your credit health, especially if the COVID-19 pandemic stretches on longer than predicted. Keep these tips in mind:

- Make improvements now. Being proactive and saving a dollar today might be one you need for something essential in the near future.

- Don’t skip your health insurance payments and explore the tax credit options available to you on healthcare.gov. We are currently facing a health pandemic and there is no faster way to rack up debt than getting sick without health insurance.

- Always make minimum payments. A missed $50 minimum payment can cost you $60 in late fees and dozens of points on your credit score.

- Remember that this will end and if you did make credit mistakes along the way there are ways to help improve your credit, including working with a qualified credit repair company like My Credit Guy.

Watch the video below with Sam Parker, CEO of My Credit Guy, for more credit health information.