3 Ways AIME Can Help You Maintain and Grow Your Mortgage Brokerage

Before AIME, mortgage brokers were mostly on their own. Not only did brokers often look at each other as competition, but they rarely had a way to resolve issues with lenders or a platform to share knowledge with each other. That all changed with the founding of AIME almost 4 years ago.

Now brokers have the ability to escalate issues with AIME’s lender partners to get their issues resolved in a timely and efficient manner. Brokers also have the opportunity to be positioned as an expert in the industry by participating in exclusive AIME content that encapsulates the brokers are better mantra.

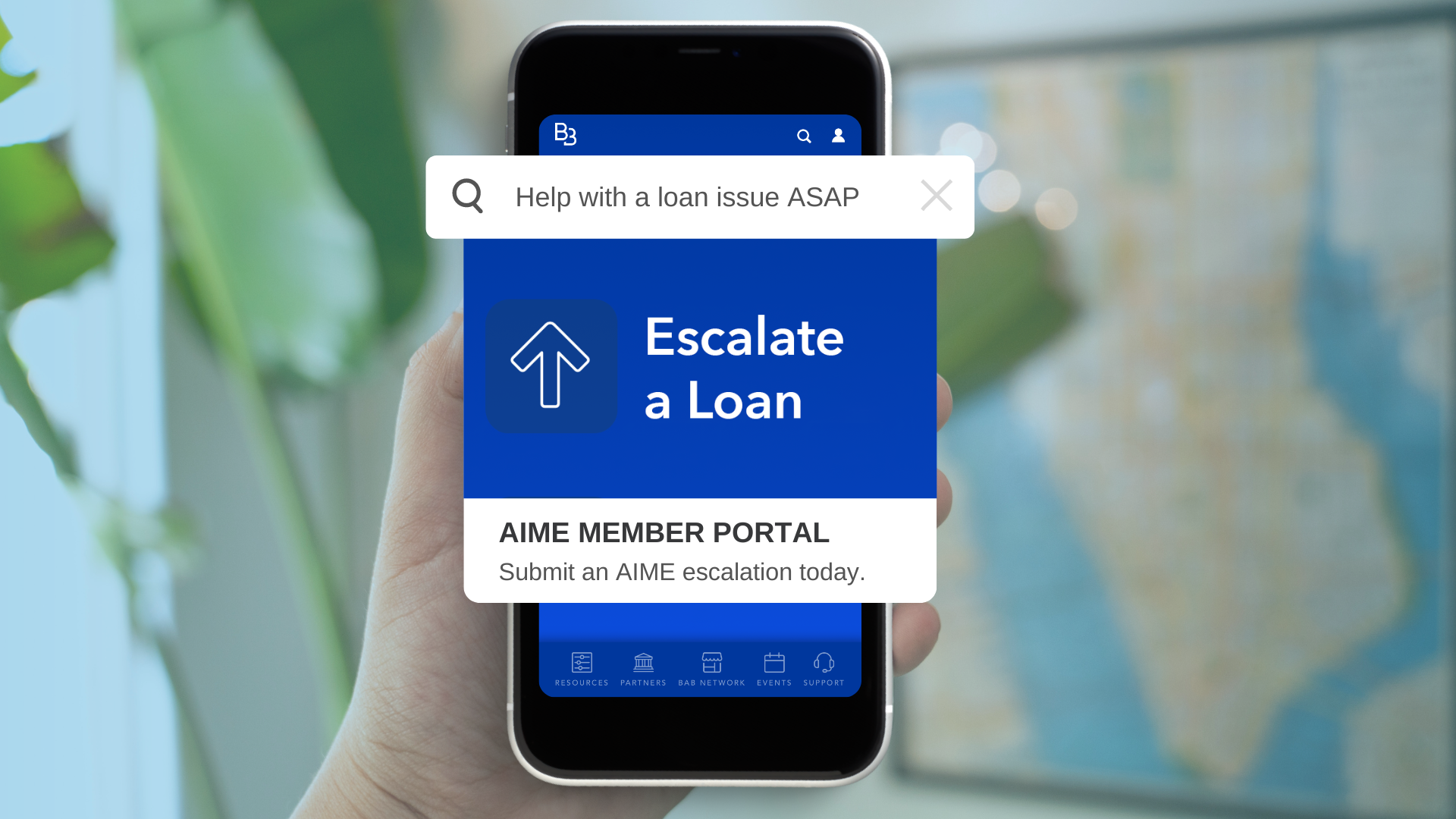

AIME Can Assist with Lender Escalations

In the mortgage industry, there is a multitude of issues that are out of the broker’s control. One of the major issues a broker can run into is complications with their lender. That is where AIME can offer help and the opportunity for a satisfactory resolution to the broker’s issue.

Any brokers who have issues with AIME’s lender partners can fill out an escalation form. From there, the AIME team will work directly with the lender to solve the issue. AIME is highly successful with its escalations with over 93% of issues escalated to AIME ending in a positive outcome for the broker.

Two brokers who benefitted from an escalation were Ryan and Jessica Ehler of Ehler Lending Team. In April of this year, the Ehlers ran into an issue with what should have been a simple loan. Adding to the complication, a local realtor partner was using this loan to test out the Ehlers.

The first complication came after the AMC turned in their report a week late, which significantly delayed the loan process. When they finally got the report, it went to desk review, delaying it even further. At that point, Jessica had gone through every channel at her disposal with no luck at resolving the problem.

That is when she decided to file an escalation with AIME. Within hours, the issue had been resolved and the loan was able to advance. If Jessica never filed the escalation, the loan would have been delayed by at least three to four more days, she said.

Not only did the escalation help move the loan along, but it also saved the Ehlers’ reputation with their potential new realtor partner.

“Since it was such an easy deal, if we mess it up, they’re not going to come back to us for anything,” Jessica Ehler said. “Our reputation is what we built our business on.”

Increase Brand Awareness by Being Featured in AIME Content

AIME has a variety of both member-facing and public-facing content community members can be featured in. From the Sales Rally and Broker Playbook to the Broker to Broker podcast, there is a variety of AIME content members can utilize to highlight their expertise as local housing leaders. These videos can go a long way in terms of establishing name recognition for brokers in their communities.

Tyler Hodgson, President of NXT Mortgage, was a guest on the Broker To Broker in May of this year. The exposure he received from the podcast helped Hodgson land two loans.

Not long after coming on the podcast, he received an application for a refinance. When he reached out to the borrower, he found out they decided to send him their business after they listened to Hodgson’s podcast episode.

“Because my borrower saw my podcast and listened to it, I was able to close a deal,” Hodgson said. “That’s a direct success story of how AIME has helped me.”

Hodgson ended up helping the client close two refinances on their primary residence and investment property. Those two loans brought $17,414 of revenue for NXT Mortgage, Hodgson said.

Potential Value of Consumer Exposure

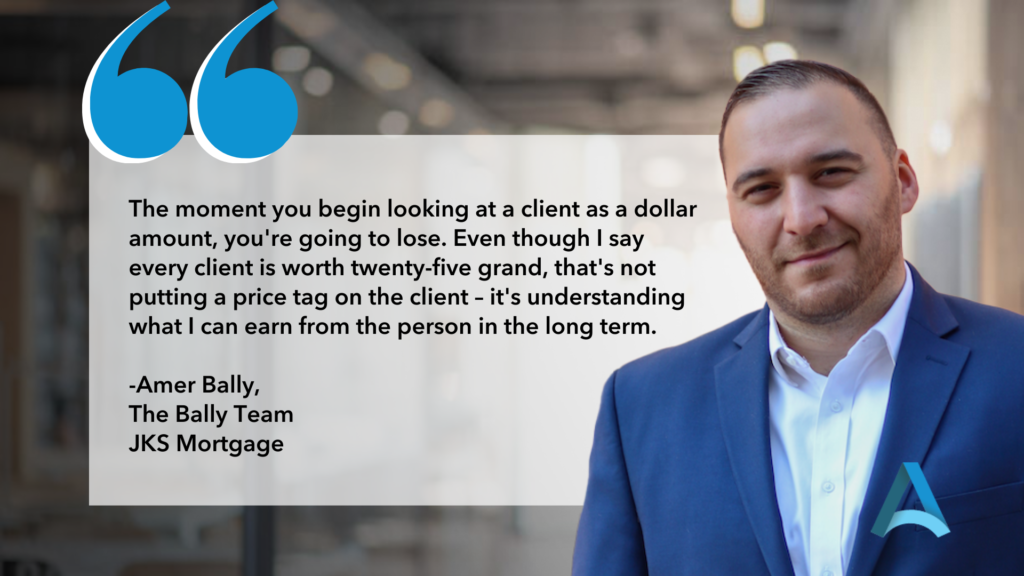

That $17,000 figure is the value of just those two loans, but what is the value of the potential referrals that can come from one client? Amer Bally of Bally Team Mortgage has an equation for that.

Bally values a single borrower at roughly $25,000. That $25,000 figure not only accounts for the initial borrower’s loan but also from the many referrals a client may give you after their loan closes.

“You make four or five grand on your initial borrower. Then they refer you to their parents, their brother, their sister, and a cousin,” Bally said. “That means you got five loans closed from one initial loan.”

Of course, that referral ripple effect relies on a positive experience for the borrower. For Bally, that starts by “treating every client like they’re his first client.” That means giving them perfect processing, with a good loan and great service closing. Bally also keeps in constant communication with his client touching base two to three times a week.

Once the loan closes, he uses a series of touchpoints to keep that relationship going. Those touchpoints include a thank you card and gift on their closing day, birthday cards, and Christmas gifts. Bally expects to send over 700 Christmas gifts this year alone.

Key Takeaways

AIME offers a variety of ways for brokers to maintain and grow their brokerages. From escalating an issue with a lender and bringing your brand stronger consumer awareness by being featured in exclusive content, AIME offers mortgage brokers tools they won’t find anywhere else.

- Utilize AIME’s escalation process to get help with loans with AIME’s lender partners

- Get featured in AIME content to get more consumer awareness and potential business

- A successful client relationship can lead to multiple referrals

- Set up touchpoints to maintain a relationship with your past clients to organically encourage referrals